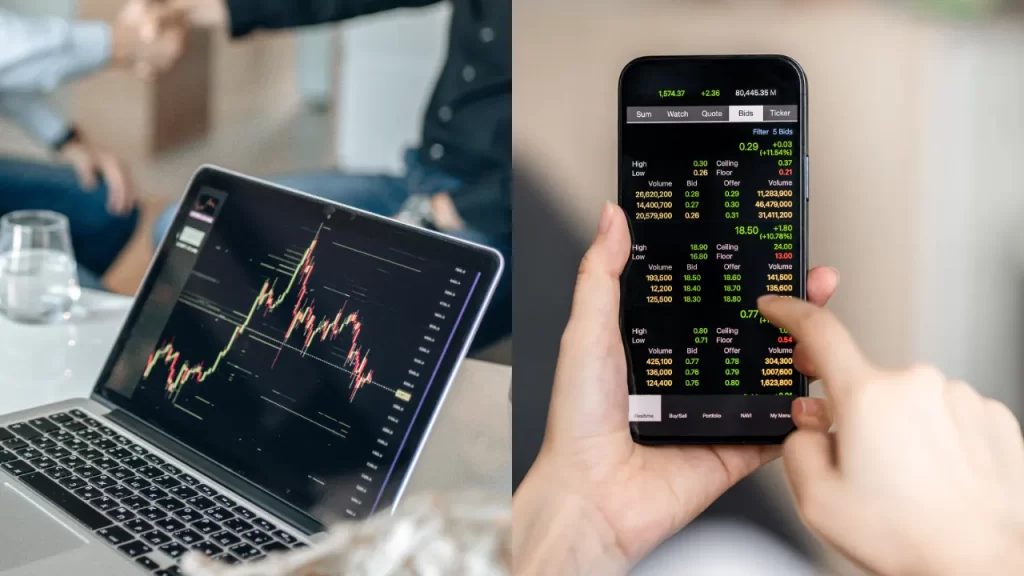

With advancements in mobile technology, CFD trading has become more accessible than ever. Traders can now execute trades, monitor markets, and manage risk from their smartphones or tablets.

This guide explores the benefits, tools, and best practices for mobile CFD trading to help traders stay connected to the markets wherever they go.

Benefits of Mobile CFD Trading

1. Convenience and Accessibility

- Trade anytime, anywhere without needing a desktop computer.

- Stay updated with market movements and breaking news in real-time.

2. Speed and Flexibility

- Execute trades instantly with a few taps on a mobile device.

- React quickly to market changes and take advantage of opportunities.

3. User-Friendly Interfaces

- Mobile trading apps offer intuitive navigation and streamlined features.

- Customizable dashboards make it easier to monitor positions and charts.

4. Risk Management on the Go

- Set stop-loss and take-profit levels from anywhere.

- Receive push notifications for price alerts and trade execution updates.

Best Mobile Trading Platforms for CFD Trading

1. MetaTrader 4 (MT4) & MetaTrader 5 (MT5)

- Industry-leading platforms with full mobile functionality.

- Advanced charting tools and multiple order types.

2. cTrader Mobile

- Designed for professional traders with enhanced charting and execution speed.

- Allows access to a wide range of CFD instruments.

3. IG Trading App

- Offers real-time data, alerts, and risk management tools.

- Includes educational resources for beginner traders.

4. eToro Mobile App

- Social trading features allow traders to copy experienced investors.

- Easy-to-use interface with cryptocurrency and CFD support.

How to Trade CFDs on a Mobile Device

1. Choose a Reliable Trading App

- Select a regulated broker with a well-reviewed mobile platform.

- Ensure the app is compatible with your operating system (iOS/Android).

2. Set Up Your Trading Account

- Register and verify your account.

- Deposit funds using available payment methods.

3. Analyze the Market

- Use technical indicators and price alerts to identify trade opportunities.

- Stay informed with economic news and market trends.

4. Execute Trades and Manage Risk

- Place market or pending orders based on your trading strategy.

- Adjust stop-loss and take-profit levels to manage exposure.

5. Monitor Your Trades

- Regularly check open positions and make adjustments as needed.

- Use notifications to stay updated on price changes and trade executions.

Challenges of Mobile CFD Trading

1. Screen Size Limitations

- Smaller screens may make chart analysis more challenging.

- Consider using a tablet for a better visual experience.

2. Connectivity Issues

- Poor internet connections can result in delayed order execution.

- Use a stable and fast network to avoid disruptions.

3. Security Risks

- Mobile devices are vulnerable to hacking and malware.

- Enable two-factor authentication (2FA) and use a secure network.

Tips for Effective Mobile CFD Trading

- Use push notifications to stay updated on market conditions.

- Keep your trading app updated to ensure security and new features.

- Avoid emotional trading by sticking to your pre-planned strategy.

- Always have a backup device in case of technical issues.

Conclusion

Mobile CFD trading provides traders with the flexibility to manage their portfolios from anywhere.

By choosing the right platform, staying informed, and managing risks effectively, traders can take advantage of market movements while on the go.

However, challenges like connectivity and security should be addressed to ensure a smooth trading experience.